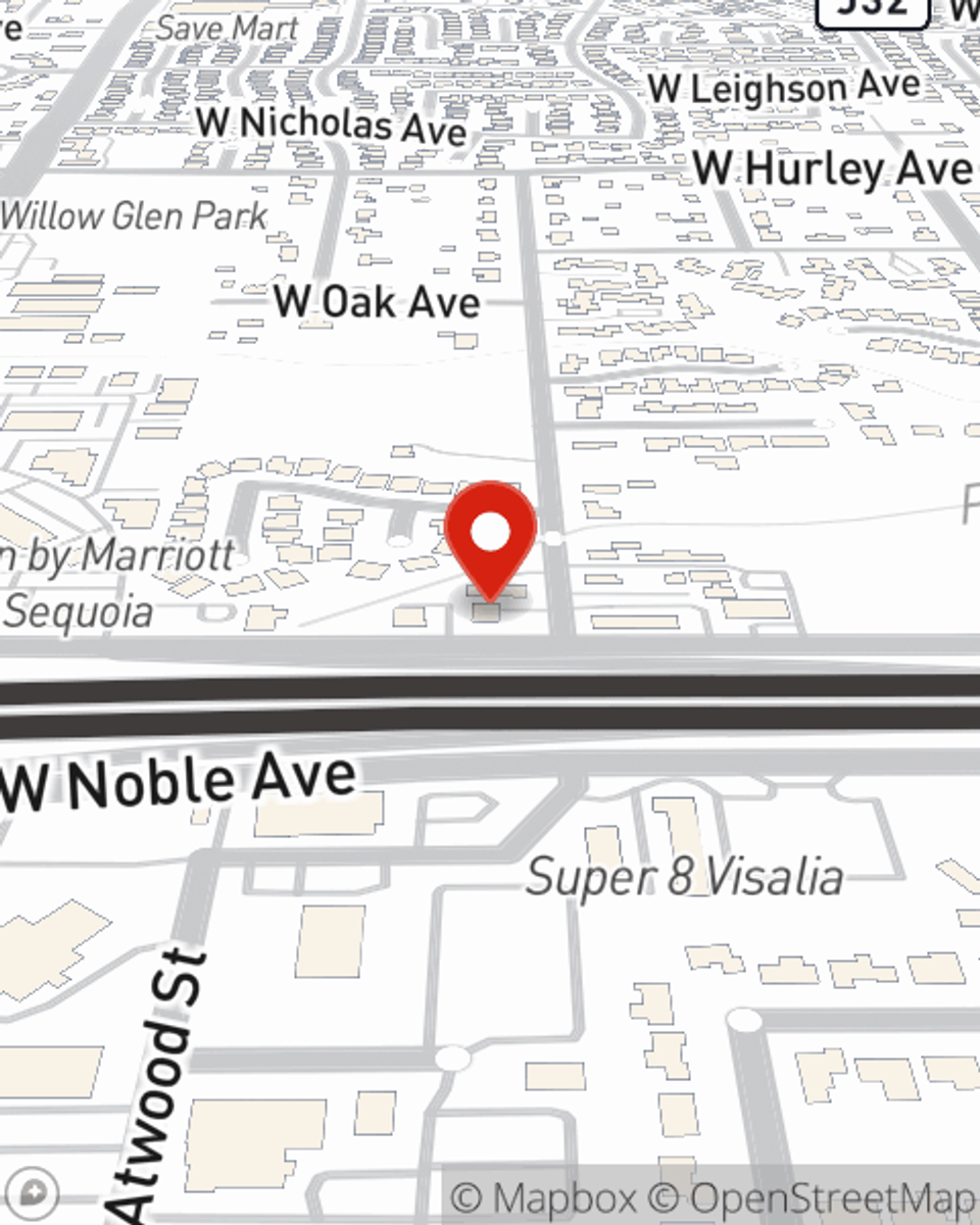

Life Insurance in and around Visalia

Insurance that helps life's moments move on

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Visalia

- tulare

- Exeter

- Hanford

- Lindsay

- Three Rivers

Protect Those You Love Most

One of the greatest ways you can protect those closest to you is by taking the steps to be prepared. As uneasy as thinking about this may make you feel, it's a great idea to make sure you have life insurance to prepare for the unexpected.

Insurance that helps life's moments move on

Now is a good time to think about Life insurance

Why Visalia Chooses State Farm

The beneficiary designated in your Life insurance policy can help cover current and future needs for your family when you pass. The death benefit can help with things such as medical expenses, retirement contributions or home repair costs. With State Farm, you can rely on us to be there when it's needed most, while also providing sensitive, dependable service.

Don’t let worries about your future stress you out. Reach out to State Farm Agent Elaine Rider today and explore the advantages of State Farm life insurance.

Have More Questions About Life Insurance?

Call Elaine at (559) 625-4330 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Elaine Rider

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.